Ads

![]() Tony M.

Tony M.

FXStreet

Shiba Inu price is in a make or break situation. These are the factors to keep in mind.

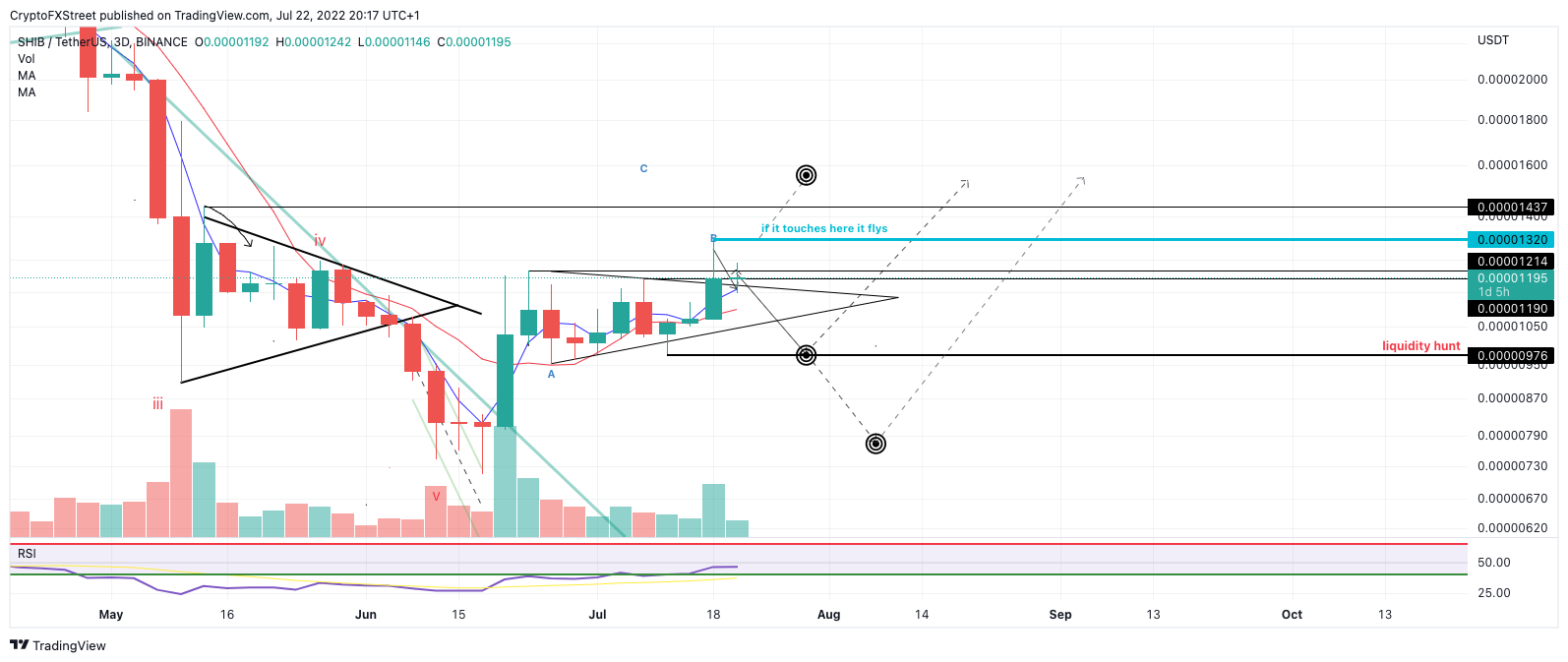

Analysts are watching the Shiba Inu price closely this weekend. If The triangular consolidation is accurate, a 30% bull rally will commence for the notorious dog coin. On the contrary, deceiving triangle patterns are often smart money traps to reduce traders’ opportunity costs. In some cases, they can cause massive liquidations.

Shiba Inu price currently trades at $0.00001197. The fact that the SHIB price has not yet rallied impulsively on smaller time frames from the triangle breakout is the first anomaly to provoke concern. Additionally, according to the Relative Strength Index, the self-proclaimed DOGE killer is far from bullish on larger time frames.

SHIB/USDT 3-Day Chart

Thus traders who may have already bought the Shiba Inu false breakout into the high at $0.00001320 will enjoy exceptional returns for their early bullish entry or could endure more congestion and potentially sell-offs over the weekend. Bearish targets are $0.00000976 and possibly $0.00000750 for up to a 35% decline from Shiba Inu’s current market value.

Invalidation of the bearish outlook to provoke the next bull run is a breach above $0.00001320. If the invalidation level is tagged, bears should immediately release their shorts and join the bulls as a rally towards $0.00001580 will be the first target. Extended targets are in the $0.00001750 zone for up to a 50% increase from the current Shiba Inu price.

In the following video, our analysts deep dive into the price action of Shiba Inu, analyzing key levels of interest in the market. -FXStreet Team

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Bitcoin price has noticed a large shift in sentiment from being overly bearish to optimistic. Although greed is still out of the equation, things could soon reach these levels, especially if the trend continues as it has over the last ten days.

As Cardano’s Vasil hard fork and Ethereum’s Merge is fast approaching, the crypto community pitted the two competitors against each other, comparing features and scale.

Ethereum price and its gains since July 13 are currently being questioned as bulls hint at weakness. If certain requirements are met, however, things could develop in a way that favors buyers.

The co-founder of Polygon explained why MATIC is the only staking token for all chains, and gas fees will be collected in Ethereum by default. While gas fees are not being collected in MATIC, Nailwal assured the crypto community that value gain is imminent.

Bitcoin price has noticed a large shift in sentiment from being overly bearish to optimistic. Although greed is still out of the equation, things could soon reach these levels, especially if the trend continues as it has over the last ten days.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and Omissions may occur.Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, partners or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Ads