Ads

![]() FXStreet Team

FXStreet Team

FXStreet

Tron’s TRX price shows strong macro technicals pointing to a potential 2,000% rally from 2024 to 2025. Tron’s TRX price has been coiling in a mundane fashion for most of the summer. When reviewing the macro technicals, it appears that a triangular pattern is taking place, justifying the lackluster price fluctuations.

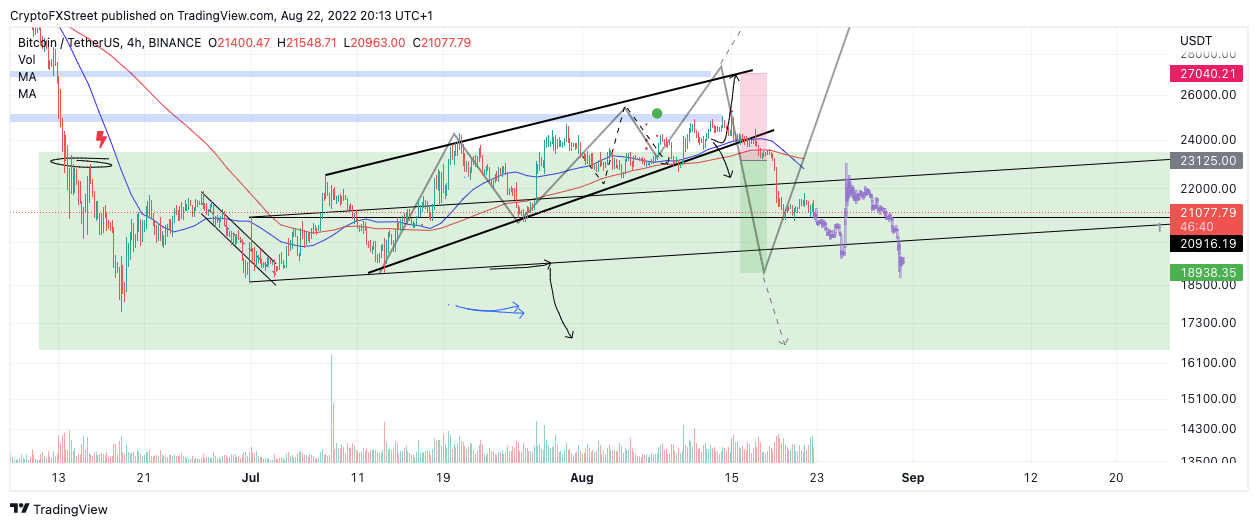

Bitcoin price has fallen into bullish interest dating back to almost one month ago, near the end of July. The bulls who missed the summertime rally may be enticed to open a position in hopes that the barrier will repeat history and prompt another.

Shiba Inu price market sentiment remains optimistic despite the penny-from-Eiffel style decline. Shiba Inu price shows extremely bearish technicals, confounding that a sweep of the lows event could be underway. The technicals suggested that an immediate liquidation could occur after a five-wave impulse into the bullish targets occurred.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Bitcoin price shows a tight consolidation on a lower time frame – an ascending parallel channel – that repeats the motif of three larger channels that have developed on higher time frames since the start of 2022.

Dogecoin price is at the tail end of the most recent pullback from $0.0917. The largest meme coin pivots at $0.0686 at the time of writing, but it’s expected to close the distance to $0.1000 with its next move. Anticipation of the release of a Dogecoin-Ethereum bridge may prove a bullish catalyst.

Ethereum (ETH) price is set to enter a rare moment of silence as liquidity thins towards 16:00 CET, and traders await the comments from Fed chair Jerome Powell at one of the most important central bank events of this year.

Tezos (XTZ) price action is on the cusp of printing some violent swings as Fed chair Powell preparesto make one of his biggest speeches for the year. With investors looking for clues on what to do, the initial reaction will probably be a dovish one with a pop above a big technical hurdle. Only then will there be a substantial paring back of the gains, potentially with a nuclear implosion that will continue for days.

Bitcoin price shows a tight consolidation on a lower time frame – an ascending parallel channel – that repeats the motif of three larger channels that have developed on higher time frames since the start of 2022.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and Omissions may occur.Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, partners or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Ads