Ads

![]() Ekta Mourya

Ekta Mourya

FXStreet

Dogecoin and Shiba Inu prices plummeted alongside Bitcoin, Ethereum and other cryptocurrencies in the top 30 ahead of the FOMC meeting. Analysts are optimistic, however, that Dogecoin will breakout from its multi-year trendline.

Also read: Dogecoin copycat gets rug pulled plummets 99% overnight

The Federal Open Market Committee meets eight times a year to discuss monetary policy changes and reviews economic and financial conditions to assess the stability of prices in the economy. The FOMC is meeting on Wednesday for an anticipated 75 bps rate hike. Investors were risk averse ahead of the event and pulled out capital from cryptocurrencies; therefore, assets in the top 30 witnessed a steep decline.

Dogecoin and Shiba Inu prices plummeted, and the meme coins failed to recoup losses two weeks ago. Investors are sitting on their hands as experts have predicted a 75 bps hike on Wednesday. The current condition in the crypto markets is considered typical ahead of the FOMC meeting.

Market participants have anticipated a third mega hike in September 2022. Monetary policy is tightening quicker than thought, and growth is slowing down. This environment has resulted in capital outflow from meme coins and the DeFi ecosystem.

Whale activity on the Dogecoin network has increased significantly after the meme coin’s dominance spike. Based on data from crypto intelligence firm Santiment, Dogecoin and Shiba Inu are among the popular cryptocurrencies in whale portfolios.

Crypto investors who spent over $100,000 per transaction are accumulating DOGE, and there are 100+ large transactions daily on the Dogecoin network.

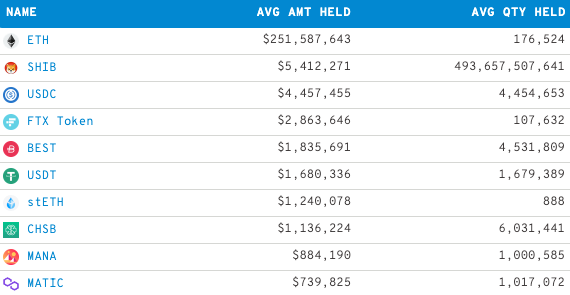

Shiba Inu is one of the largest non-Ethereum holdings of the top 100 Ethereum whales. Based on data from WhaleStates, whales hold a total of 493.65 billion Shiba Inu worth $5.4 million.

Top 10 holdings of 100 largest Ethereum whales

Analysts at FXStreet believe that Dogecoin is ready to break out of its multi-year trendline. Since May 2021, the Dogecoin price has declined rapidly, but now the asset is ready to recover. Except for a few bounces in its price chart, Dogecoin price has steadily declined, losing 91.6% of its value year on year. For target prices and further information on the Dogecoin chart, check the video below:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Tezos macro’s outlook can no longer be considered an impulse wave. A complex correction or sharp decline is now on the cards. Both scenarios make XTZ price unpromising. Tezos price shows bearish involvement.

The drop in Ripple price does not look like an ordinary sell-off. Market sentiment may be snoozing behind the wheel. XRP price could be heading for a devastating decline in the coming days if market conditions persist.

LINK has been trying to brave the volatile cryptomarket by pushing for gains north of its current market value of $6.30. A symmetrical triangle pattern started forming around mid-July and elevated LINK to $7.50 last week but missed its target at $8.60.

A brief technical and on-chain analysis on Cardano price. Here, FXStreet’s analysts evaluate where ADA could be heading next.

Bitcoin price has noticed a large shift in sentiment from being overly bearish to optimistic. Although greed is still out of the equation, things could soon reach these levels, especially if the trend continues as it has over the last ten days.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and Omissions may occur.Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, partners or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Ads