Ads

![]() Ekta Mourya

Ekta Mourya

FXStreet

Shiba Inu suffered a massive drop in its price in the recent crypto bloodbath. While Shiba Inu price posted double-digit losses, experts believe the release of the beta phase of Shibarium could trigger a recovery in the meme coin.

Also read: Ethereum whales scoop up 150 billion Shiba Inu coins as burn intensifies

The recent crypto bloodbath has taken a toll on most of the top cryptocurrencies. Bitcoin price slipped to the $20,200 level. Meme coins Shiba Inu and Dogecoin suffered massive drops in price, posting double-digit losses overnight. Danielle Du Toit, a leading crypto analyst, evaluated the Shiba Inu price chart and noted that SHIB price has dropped nearly 18% since June 26.

Nevertheless, the Momentum Reversal Indicator (MRI) has flashed a buy signal on the four-hour price chart. Any increase in buying pressure could push the Shiba Inu price to retest $0.0000104.

Shiba Inu Perpetual Futures

Based on data from Coinglass, as Shiba Inu price plummeted 10% overnight, it triggered $1.44 million in liquidations of SHIB futures across exchanges. The following chart offers insight in the liquidation of short and long positions in Shiba Inu across exchanges.

Total liquidations in Shiba Inu longs and shorts against price

Experts attribute the Shiba Inu price rally that preceded the bloodbath to fundamental reasons. Adam O’Niell, CMO at leading cryptocurrency exchange Bitrue, was quoted as saying,

The parabolic move by SHIB is mainly fueled by the coming Shibarium protocol. This move is also partly coming from the SHIB burnt token that has reached a total of 400 trillion milestones.

The Shiba Inu coin burn portal, Shibburn, was launched in late April this year. The portal started tracking the burn of the SHIB tokens. These coins sent to dead wallet addresses were considered burnt and permanently removed from the circulating supply.

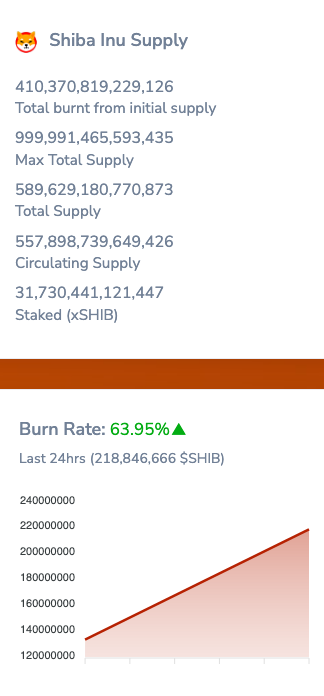

The portal was developed in association with Ryoshi’s Vision token developers and 0.49% of all RYOSHI transactions would be distributed to owners of burntSHIB. Burn rate climbed 63.95% overnight, as 218.84 million Shiba Inu coins were destroyed. A total of 410.37 trillion Shiba Inu coins have been burnt, pulled out of circulation.

Shiba Inu coin burn statistics

The ShibArmy is still awaiting the official announcement for the launch of layer-2 solution Shibarium and Shiba Games, two projects that are set to roll out anytime in 2022. With several projects under development in the Shiba Inu ecosystem, experts consider the meme coin a community-driven effort.

Shibarium, Shiba Inu ecosystem’s layer-2 solution, could see the release of its beta phase as early as Q3 2022. Developers at Unification Foundation announced on June 24 that Shibarium’s public beta is set to be deployed in Q3 2022.

On June 19, developers asked the Shiba Inu community to vote on whether or not to halt the minting of BONE on hitting the 230 million token cap. Since Shibarium is set to use BONE for payment of transaction fees, validators would receive BONE tokens for their role in the ecosystem. Validator roles and sequences will require 20 million BONE as a safeguard.

Members voted in favor of the proposal and accepted BONE’s mint to be capped at 230 million, and the remaining 20 million to be reserved for Shibarium validators.

Experts believe the release of Shibarium could trigger a recovery in Shiba Inu price as the layer-2 solution would reduce transaction cost and processing time for the meme coin.

Analysts at FXStreet believe the Shiba Inu price trend is still bullish. Shiba Inu price flipped resistance at $0.0000095 to support and analysts expect the meme coin to overcome next resistance at $0.0000104. Shiba Inu price trend could turn bullish, however traders need to watch out for one condition. Check out the video for more:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Bitcoin price is consolidating between significant barriers and shows no signs of moving out yet. The ongoing move could likely face rejection resulting in a steep correction that could send BTC to revisit levels last seen almost a month ago.

Ethereum (ETH) price is set to give a little bit of a blow to short-sellers as ETH price made a miraculous recovery on the back of a bounce from the $1,043 handle.

Judge Sarah Netburn ruled against the SEC’s motion to protect the William Hinman documents. This is considered a decisive win in the latest SEC v. Ripple ruling.

Solana Mobile started accepting pre-orders for Saga phones in select countries worldwide, according to a recent announcement. Analysts believe Solana’s price rally is short-lived and upside is capped at $44.

Bitcoin price is consolidating between significant barriers and shows no signs of moving out yet. The ongoing move could likely face rejection resulting in a steep correction that could send BTC to revisit levels last seen almost a month ago.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and Omissions may occur.Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, partners or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Ads