Ads

![]() FXStreet Team

FXStreet Team

FXStreet

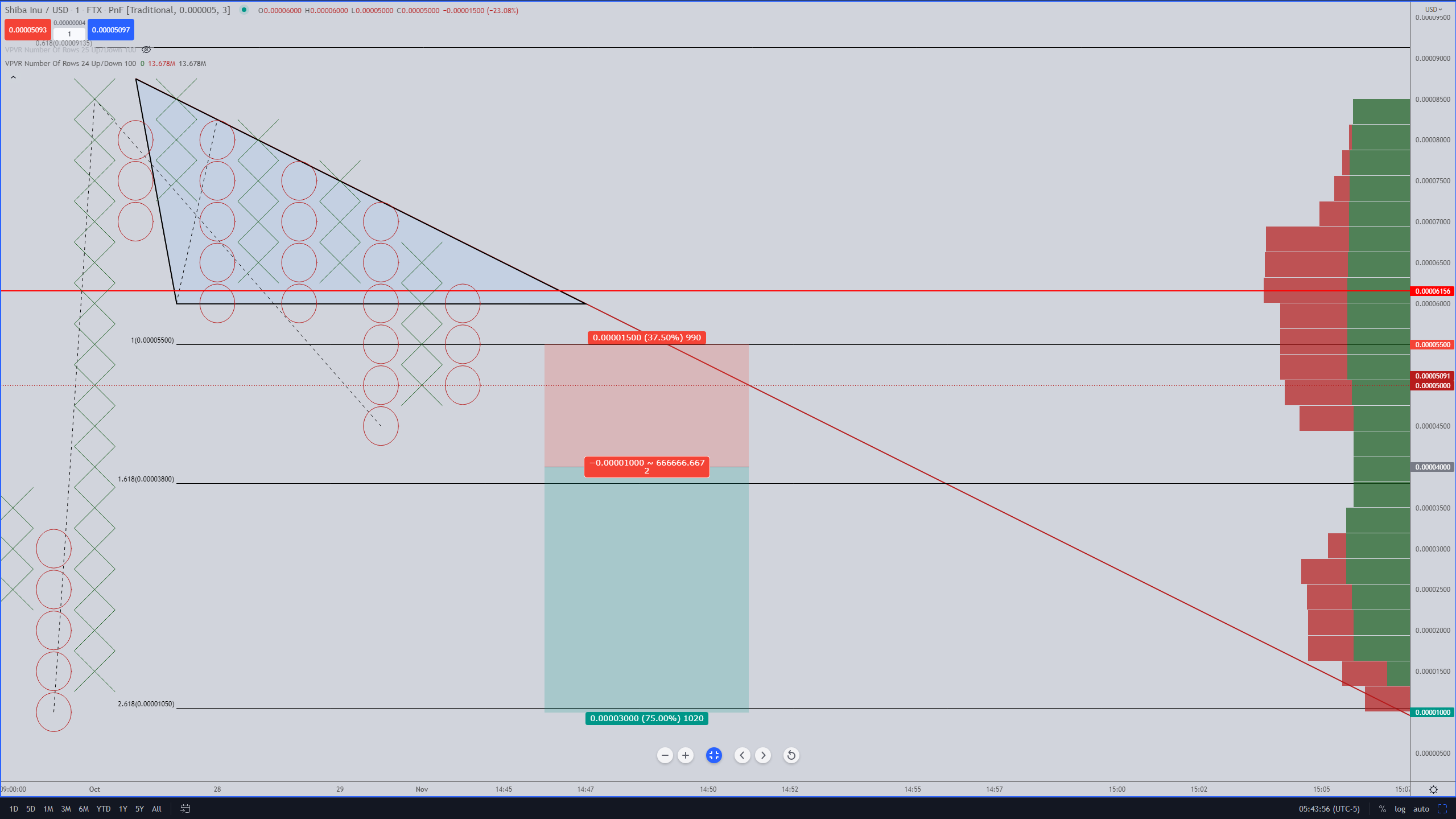

Shiba Inu price found itself a victim of the selling pressure faced across all financial markets on Wednesday. Shiba Inu has found some technical support at the 50% Fibonacci retracement at $0.000049, but buying appears to be drying up. As a result, Shiba Inu is very much at risk of a capitulation move towards $0.0000100.

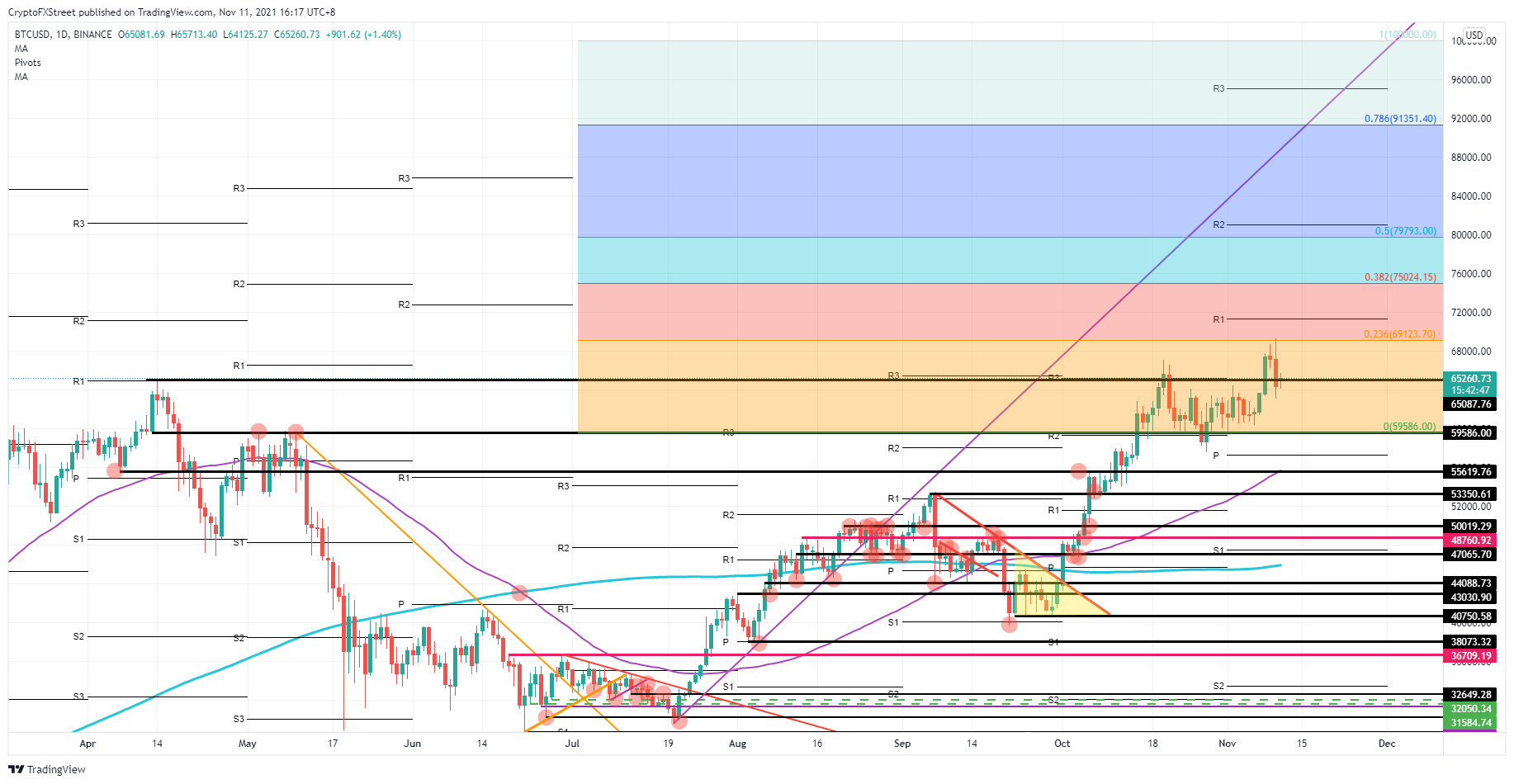

Bitcoin price popped higher yesterday and made new all-time highs around $69,123.70, but then came under pressure from profit-taking in the US session as global markets got rattled by higher-than-expected inflation data. A similar pattern unfolded for both Ethereum and Ripple price action. With the US session closed today, investors will have a chance to reassess the situation and look beyond the inflation print to determine if markets will open in risk-off mode tomorrow or will shake off the inflation worries and focus back on the several bull runs that are ongoing.

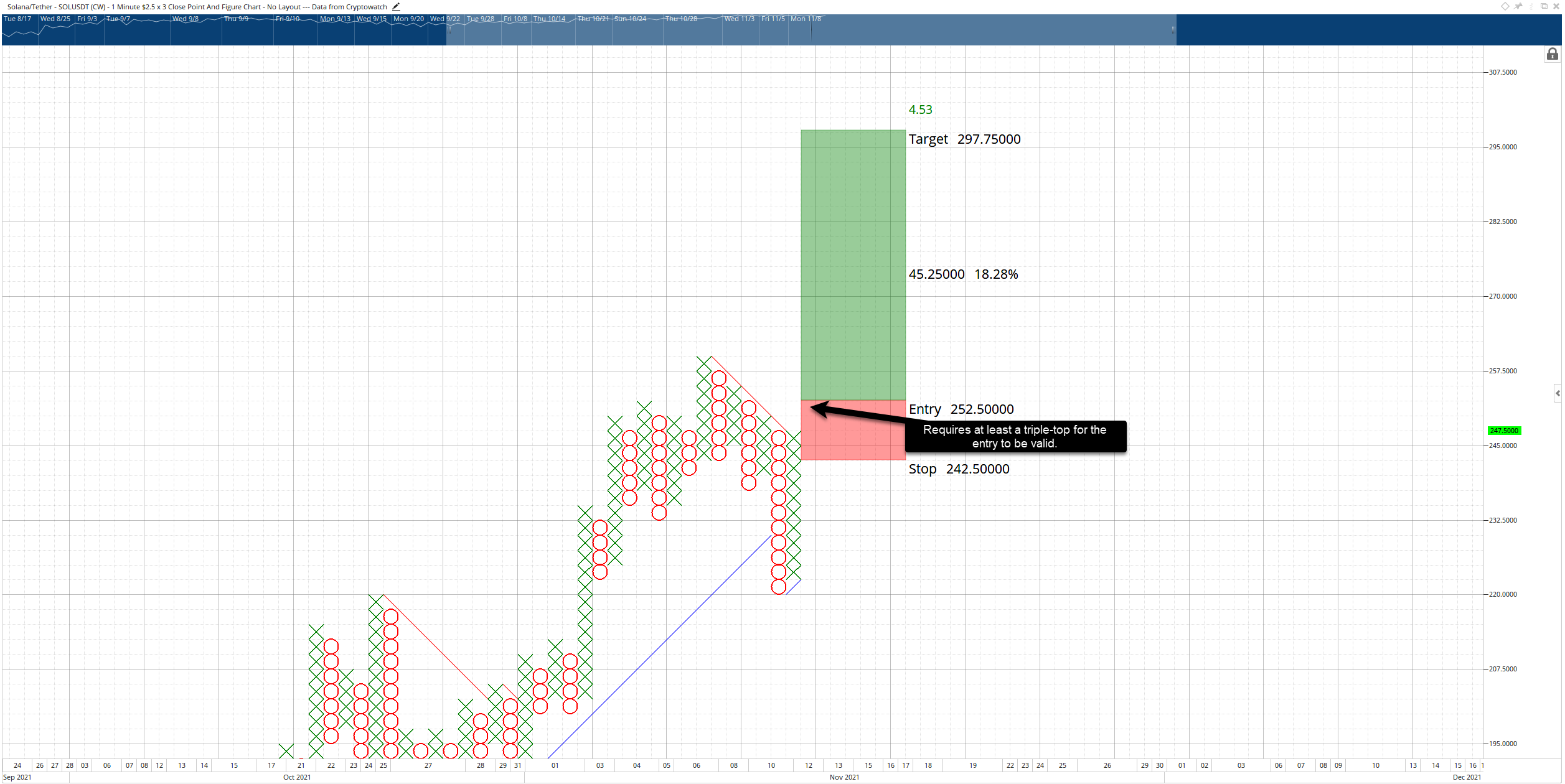

Solana price was at more risk of a catastrophic move lower during Wednesday’s selling pressure than most cryptocurrencies. It is a testament to Solana’s strength and bullish sentiment that not only was the retracement limited, but Solana continued to trade near its all-time highs. Two trade possibilities are now present.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Bitcoin price has been ranging since June 18, but rumors of insolvency have been spreading on multiple popular platforms in the industry. KuCoin, the fifth-largest cryptocurrency exchange in the world is at the center of bankruptcy rumors.

Former Chief Robert Cohen believes the Securities & Exchange Commission’s (SEC) ’s case against payment giant Ripple is key, however the outcome may not be as significant. The regulator is likely to file a motion for reconsideration on losing the case against Ripple.

The electric car manufacturer faces a dire fate as its Bitcoin holdings further devalue amidst a market rout that is seeing whales readying to sell by rapidly pouring their Bitcoin onto crypto exchange platforms. Tesla is already facing a $440 million writedown of its Bitcoin holdings after the recent crypto market bloodbath, and could face even more.

Dogecoin price managed to slow down its bleeding in the second and third week of June but now sellers seem to have come back. As a result, DOGE is undergoing a minor retracement, but the recent adoption of certain DOGE payments by Door Dash and Uber Eats will be a value add to the fundamentals of the meme coin.

Bitcoin price ended Q2 with a -56% return, which is the first in its 11-year history. On-chain metrics hint at bottom formation but technicals reveal more room to the downside. Bitcoin price has finished the first half of 2022 and things are not looking good. With record negative returns, BTC is likely to continue heading lower, especially if one particular support level is breached.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and Omissions may occur.Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, partners or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Ads