![]() Ekta Mourya

Ekta Mourya

FXStreet

Shiba Inu announced a partnership with a world-class visualization studio to design and develop its highly-anticipated SHIB.io metaverse. The Third Floor is famous for its work on the tv shows and films in Marvel’s Cinematic Universe. Analysts have predicted a spike in Shiba Inu price with the ongoing developments and the recovery in the meme coin.

Also read: Shiba Inu holders beware! Fake SHI, TREAT have hit the market

Since its announcement, Shiba Inu holders have awaited the launch of SHIB.io, the Metaverse Project. Typically, new developments and launches in the Shiba Inu ecosystem positively impact the meme coin’s demand across exchanges and boost its price in the short term.

Therefore, the new partnership with Marvel Cinematic Universe’s long-term collaborator is expected to offer world-class visualizations, designs and development to the Shib.io metaverse. TTF is one of the largest visualization studios and has collaborated on projects in Hollywood and worked with top directors and designers on stories of all scales. -637939835733898255.jpg)

Visualization by The Third Floor

The Third Floor will work on visual development and storytelling to help define and develop virtual environments, buildings and landmarks within the Shiba Inu-inspired universe and a marketplace to inform final environment production.

TTF’s rapid prototyping, real-time processing and creative iteration will take ideas from concepts to reality in the Shib.io metaverse.

Shib.io metaverse first look

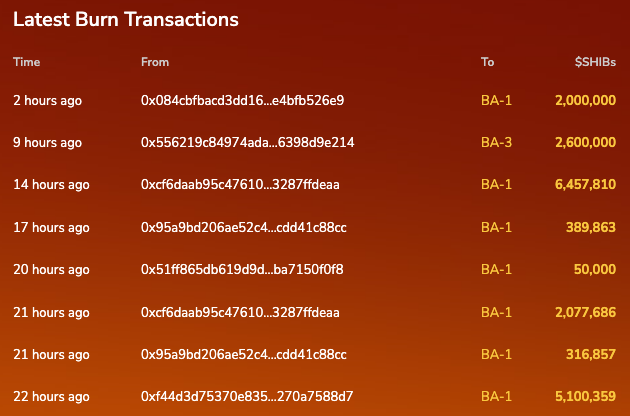

Based on data from the Shibburn portal, 18.99 million Shiba Inu tokens were burnt over the last 24 hours in eight transactions. A total of 410.37 trillion Shiba Inu tokens have been burnt so far, which means they were destroyed permanently by being sent to a dead wallet.

Over the past week, a billion Shiba Inu tokens were burnt, sending them to dead wallets and pulling them out of circulation. The reduction in circulating supply impacted the value of the remainder of the tokens held by ShibArmy members. It is estimated that consistent burns will eventually increase the value of SHIB held by the community as the circulating supply shrinks.

Shiba Inu burn transactions from the last 24 hours

Analysts at FXStreet evaluated the Shiba Inu price trend and identified key indicators and metrics that could push the meme coin 40% higher. The Dogecoin-killer has bullish potential and is on the cusp of a breakout. For key price levels and more information on Shiba Inu price, check out this YouTube video by FXStreet:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Bitcoin price witnesses a massive surge in volatility after the release of the Consumer Price Index (CPI) on Thursday. An initial drop in price is later taken over by buyers, resulting in a sharp move to the upside.

XRP price continues to remain strong relative to other altcoins despite the recent downturn. Regardless, the crypto markets seem to be shifting their bias to favoring bulls, so investors can expect Ripple to continue its ascent.

TRON price has been hovering inside a bearish setup that forecasts a massive crash. However, due to the latest developments, things are starting to flip bullish.

The last two quarters have been full of surprises for the crypto community, with the third quarter in particular, being the most volatile.

Bitcoin price triggered a bullish reversal after October 13 CPI that is reminiscent of the July 13 events. The transaction data shows that a flip of $22,000 will open the path for BTC to head up to $27,000.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and omissions may occur. Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, clients or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.