![]() FXStreet Team

FXStreet Team

FXStreet

Dogecoin price has lost 30% gains made this summer. A rise back towards all-time highs would result in 1,000 percent (10x) from DOGE’s current market value. A breach above $0.10 could be the first impulse wave of the future 10X rally.

Shiba Inu price is mirroring technicals forecasted throughout the beginning of summer. If market conditions persist, a breach of the July 13 swing low at $0.00000970 will likely occur. Shiba Inu price shows bearish signals that investors ought to be aware of. Since July, the notorious meme coin was setting up a bullish spike towards $0.00001700.

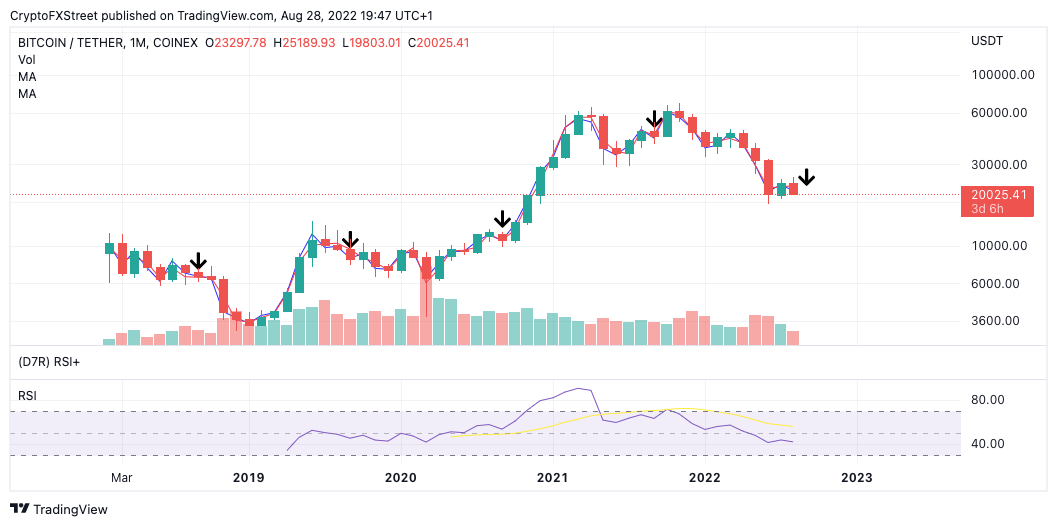

Bitcoin price could be communicating what to expect throughout the Fall as bearish signals continue to advance during the final days of August. Bitcoin price has fallen 20% since last week’s $25,211 high was briefly established.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Bitcoin price witnesses a massive surge in volatility after the release of the Consumer Price Index (CPI) on Thursday. An initial drop in price is later taken over by buyers, resulting in a sharp move to the upside.

XRP price continues to remain strong relative to other altcoins despite the recent downturn. Regardless, the crypto markets seem to be shifting their bias to favoring bulls, so investors can expect Ripple to continue its ascent.

TRON price has been hovering inside a bearish setup that forecasts a massive crash. However, due to the latest developments, things are starting to flip bullish.

The last two quarters have been full of surprises for the crypto community, with the third quarter in particular, being the most volatile.

Bitcoin price has been in a steady consolidation for more than two weeks and shows no signs of directional bias. However, the Non-Farm Payrolls (NFP) announcement on October 7 could trigger a volatile episode for BTC that could resolve its range tightening and establish a directional bias.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and omissions may occur. Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, clients or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.