- Shiba Inu price is in recovery mode, pushing north after a 36% slump from the August 12 peak of $0.00001136.

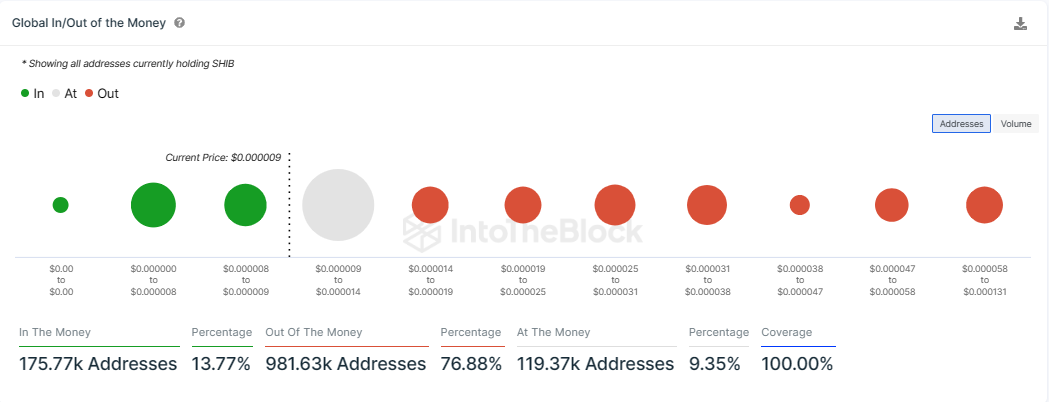

- At the current price, only 175,770 addresses are in profit, making up 13.77% of the community.

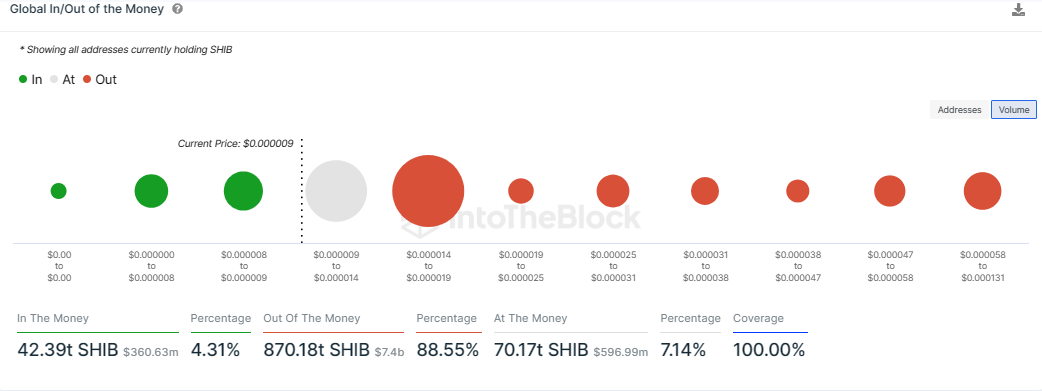

- Regarding volume, only 4.31% of tokens are in the profit zone, against the 88.55% who would look to sell at a loss or break even.

Shiba Inu (SHIB) price is attempting a recovery after a stark downtrend that was made worse by the floppy launch of the Ethereum Layer-2 network, Shibarium. As reported, network overload caused millions worth of Ethereum (ETH) to get stuck in the bridge. Though the network’s leader, Shytoshi Kusama, quelled concerns, the unfortunate news denied dog-themed meme coins, SHIB and BONE especially, from attaining the rally that had been anticipated.

Shiba Inu price attempts a recovery

Shiba Inu price is pushing north in an attempted recovery from the 36% slump that began on August 12. The lion’s share of this fall happened on August 17, sending SHIB down over 20% as $1.7 million worth of ETH was stuck in the Shibarium chain.

The token is up 6% in the last two days, steadily advancing with the Relative Strength Index (RSI) showing rising momentum. The AO’s histogram bars are also positive, which points to bullish pressure.

SHIB/USDT 1-day chart

Data from IntoTheBlock shows that at the current price of $0.00000860, only 175,770 addresses were in the profit, making up 13.77%. This is against the 76.88% or 981,630 addresses that are currently suffering losses and the meager 9.35% that are breaking even.

SHIB Addresses

On volume metrics, only 4.31%, comprising 42.39 trillion SHIB tokens, were in the green, while the lion’s share, 88.55%, was enduring losses, accounting for up to 870.18 trillion SHIB tokens.

SHIB volume

The majority of token holders are losing money (out of the money) on their positions at current prices. These clusters act as resistance because they represent supplier congestion zones looking to sell after breaking even.

The combination of these seller congestion levels and broader industry woes like the US Securities and Exchange Commission (SEC) delaying the Grayscale GBTC to ETF conversion appeal keeps the market at bay. Further, FUD in the broader market continues to prevent the upside for cryptocurrencies, with Thursday, August 17, sending almost $1 billion in value down the drains.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin’s market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.